capital gains tax proposal details

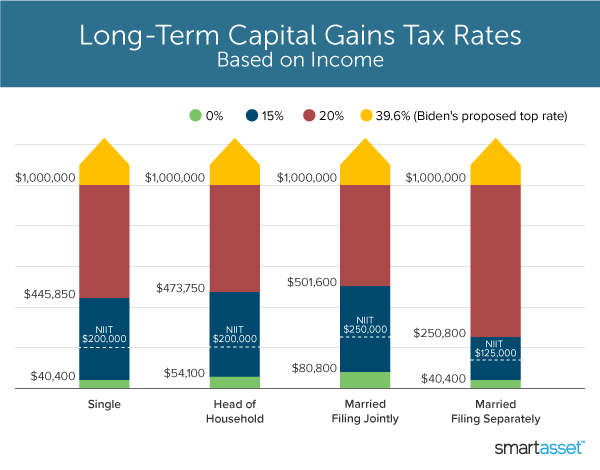

The top capital gains tax rate would be 25. Currently all long-term capital gains are taxed at 20.

Biden Tax Increase On Rich A Campaign Promise Remains White House Target Bloomberg

The plan would increase the top corporate tax rate to 265 from 21 impose a 3-percentage-point surtax on people making over 5 million and raise capital-gains taxesbut without the changes to.

. Roth IRA conversions including backdoor Roth IRAs would be prohibited for high earners. Increased High Earner Capital Gains and Qualified Dividend Rates. Investors pay ordinary income tax rates on capital gains from short-term investment held for a year or less.

Learn More About The Adjustments To Income Tax Brackets In 2022 vs. There is a risk in taking action before it becomes clear what changes Congress will make to the Administrations proposals. Democratic presidential candidate Hillary Clinton has proposed a change in the top capital gains tax rates.

Bidens campaign proposal regarding capital gainsthe details. For long-term investments held more than a year one of three capital gains rates. Therefore the top federal tax rate on long-term capital gains is 238.

The proposed plan would also mean higher taxes on foreign income. The estate tax would revert to pre-Trump levels. Subscribe to Our Newsletter.

Sole proprietor income retirement accounts homes farms and forestry are exempt. All Major Categories Covered. If this happens it means they would be taxed at ordinary income tax rates as high as 396.

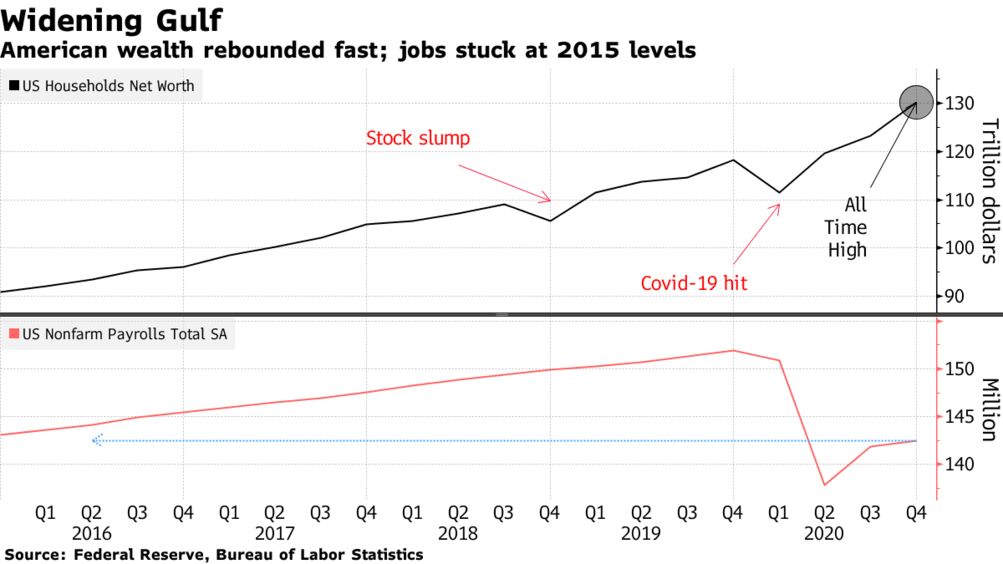

The current long-term capital gains tax rates are 15 20 or 23. Bidens campaign proposal regarding capital gainsthe details. Taxpayers with an income of over 1M could lose their preferential 20 treatment on long-term capital gains.

Bidens proposal would result in an average tax increase of nearly 300000. Although the Final Report addresses various tax issues debate has centred in on the TWGs broad introduction of capital gains tax CGT in New Zealand as recommended by its. The law raised the standard deduction to 24000 for married couples filing jointly in 2018 from 12700 12000 for single filers from 6350 and to 18000 for heads of.

Some states structure their taxes differently. Besides this the both long term and short term capital gains are taxable in case of debt mutual. This legislation calls for increasing the top individual tax rate from 37 to 396 and raising the capital gains tax rate from 20 to 396 for taxpayers with incomes higher than 1 millionand even higher for those required to pay the net investment income tax.

The recent release of the Tax Working Groups TWG Final Report has ignited a lot of public interest in tax policy perhaps at a level not seen before. There are preferential tax rates for long-term capital gains taxes. Under the proposal a.

509300 452700 and 481000 respectively. The new tax would affect an estimated 58000 taxpayers in the first year. The current long-term capital gains tax rates are 15 20 or 238 for higher income taxpayers.

Changes to International Tax. Select Popular Legal Forms Packages of Any Category. Increasing the corporate income tax rate back up to 28 730.

State and local taxes often apply to capital gains. Under the proposal the new top rate on capital gains could be as high as 318 when combined with the surtax and an existing 38 investment income tax. This change would accelerate the return to a top income tax bracket of 396 rather than waiting until tax years following 2025.

The proposal would allow 100 of the net capital gains to be deducted. Taxes long-term capital gains and qualified dividends at the ordinary income tax rate of 396. Taxing capital gains as ordinary income for individuals making more than 1 million 800 billion revenue increase over ten years.

The state would apply a 9 percent tax to capital gains earnings above 25000 for individuals and 50000 for joint filers. Your 2021 Tax Bracket To See Whats Been Adjusted. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

The new tax would affect an estimated 58000 taxpayers in the first year. These are realized gains for assets held for at least one year. Ad Compare Your 2022 Tax Bracket vs.

The top capital gains tax rate. Those earning income above 1 million would have their capital gainswhether short-term gains or long-term gainstaxed at 396 as well. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

If this happens it means they would be taxed at ordinary income tax rates as high as 396. For the very highest-income Americans we should tax at the same level ordinary income and capital gains Deese said. In a state whose tax is stated as a percentage of the federal tax liability the percentage is easy to calculate.

It includes major revisions to the estate tax capital gains taxes and the way retirement accounts are taxed. A proposed increase in the top ordinary income tax rate from 37 to 396 would be effective starting with the 2022 tax year. Capital gains tax proposal An overview.

Korea Tax Income Taxes In Korea Tax Foundation

Biden Eyeing Tax Rate As High As 43 4 In Next Economic Package Bloomberg

Like Kind Exchanges Of Real Property Journal Of Accountancy

What S In Biden S Capital Gains Tax Plan Smartasset

Income Tax Increases In The President S American Families Plan Itep

Biden Will Seek Tax Increase On Rich To Fund Child Care And Education The New York Times

Doing Business In The United States Federal Tax Issues Pwc

What S In Biden S Capital Gains Tax Plan Smartasset

Biden Wants To Limit The Capital Gains Tax Preference History Shows It Will Be Hard

How To Tax Capital Without Hurting Investment The Economist

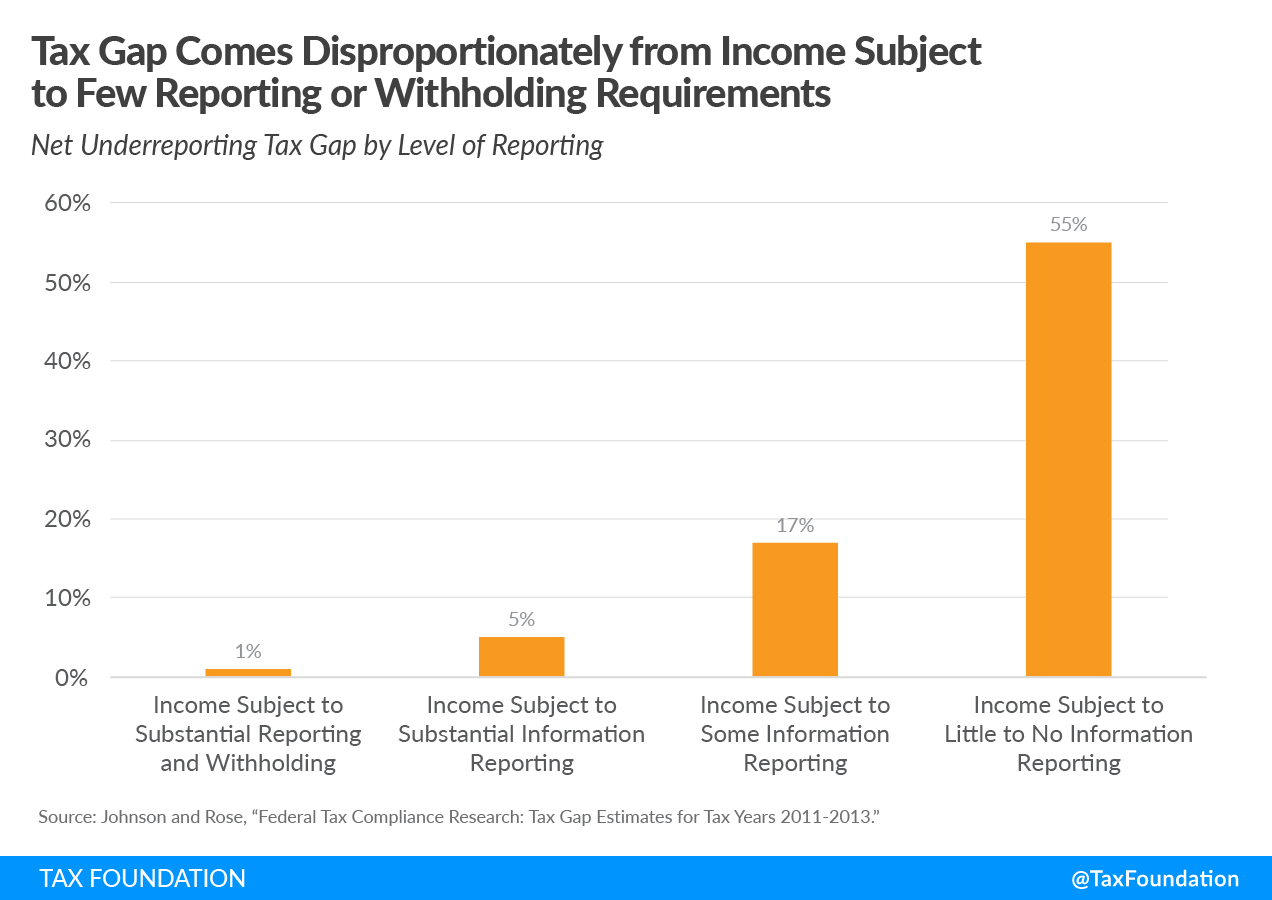

Irs Reporting Proposal Misses The Mark Tax Foundation

Trump S Proposed Payroll Tax Elimination Itep

What S In Biden S Capital Gains Tax Plan Smartasset

Democrats Weigh A Tax On Billionaires Unrealized Capital Gains The New York Times

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

Biden Budget Biden Tax Increases Details Analysis

Reconciliation Bill Capital Gains Tax Proposals Tax Foundation

10 Tax Reforms For Economic Growth And Opportunity Tax Foundation

/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)